Delve into the world of personal finance apps tailored for the digital lifestyle. Discover how these apps revolutionize the way individuals manage their finances efficiently in today's fast-paced digital era.

Explore the features, benefits, and security measures that make these apps indispensable tools for financial well-being.

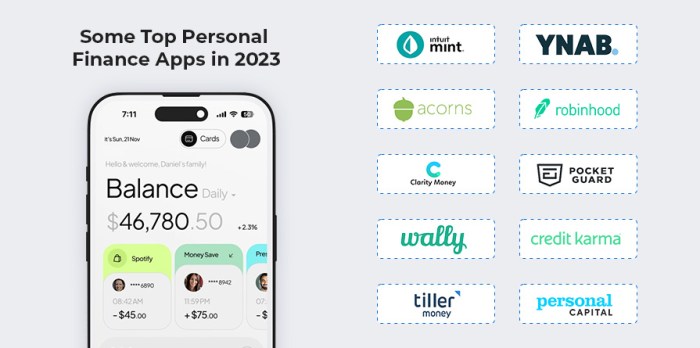

Top personal finance apps for digital lifestyle

In today's digital world, managing personal finances has never been easier with the help of various personal finance apps. These apps offer a range of features and functionalities to help users track expenses, create budgets, and achieve their financial goals.

1. Mint

Mint is a popular personal finance app that allows users to link their bank accounts, credit cards, and bills in one place. It provides a comprehensive overview of their financial situation, including spending patterns, upcoming bills, and budget tracking.

2. YNAB (You Need a Budget)

YNAB is a budgeting app focused on helping users allocate their income towards specific expenses and savings goals. It offers detailed reports and insights to help users make informed financial decisions and prioritize their spending.

3. Personal Capital

Personal Capital is a wealth management app that combines budgeting tools with investment tracking. It allows users to monitor their net worth, analyze investment portfolios, and plan for retirement, all in one platform.

4. Acorns

Acorns is an investing app that rounds up users' purchases to the nearest dollar and invests the spare change into diversified portfolios. It's a simple way for beginners to start investing and grow their savings over time.

5. PocketGuard

PocketGuard is a budgeting app that helps users track their income, expenses, and savings goals in real-time. It categorizes transactions, monitors bills, and alerts users of any overspending to keep their finances on track.

Budgeting and expense tracking

Budgeting plays a crucial role in personal finance management as it helps individuals plan their spending, save for future goals, and avoid falling into debt. By setting a budget, one can track income and expenses, identify areas where money is being overspent, and make necessary adjustments to achieve financial stability.

Budgeting Tools in Personal Finance Apps

- Mint: This app allows users to create personalized budgets, track spending, and receive alerts for overspending in different categories.

- You Need A Budget (YNAB): YNAB focuses on giving every dollar a job, helping users assign money to specific categories and track progress towards financial goals.

- Goodbudget: Goodbudget follows the envelope budgeting method, where users allocate funds to virtual envelopes for different expenses to manage spending effectively.

Tips for Tracking Expenses Using Digital Tools

- Link accounts: Connect all bank and credit card accounts to the app for automatic expense tracking.

- Categorize expenses: Assign categories to transactions for a clear overview of where money is being spent.

- Set spending limits: Establish limits for each category to avoid overspending and stay within budget.

Benefits of Real-time Expense Tracking

- Immediate awareness: Real-time tracking provides instant visibility into spending habits, helping users make informed decisions.

- Prevent overspending: By monitoring expenses as they occur, individuals can avoid exceeding their budget limits and maintain financial health.

- Better financial planning: Access to up-to-date spending data enables effective planning for future expenses and savings goals.

Investment and savings features

Investment and savings are crucial components of financial planning. Personal finance apps offer various tools and features to help users make wise investment decisions and reach their savings goals.

Investment Options

Personal finance apps provide users with access to a range of investment options, such as stocks, mutual funds, ETFs, and more. Users can diversify their investment portfolio and track their investments in real-time through these apps.

Savings Goals and Tools

Users can set specific savings goals within personal finance apps, such as saving for a vacation, emergency fund, or retirement. These apps offer tools like automated savings transfers, goal tracking, and financial calculators to help users stay on track and achieve their savings goals.

Interest Rates and Returns

Personal finance apps often provide information on interest rates and potential returns on various investment options

Building a Strong Financial Future

By utilizing the investment and savings features offered by personal finance apps, users can take proactive steps towards building a strong financial future. These features encourage users to save regularly, invest wisely, and plan for long-term financial stability.

Bill payment and financial reminders

Personal finance apps offer convenient bill payment functionalities that allow users to manage their financial obligations efficiently. These apps help users stay on top of their bills by providing reminders and notifications for upcoming payments.

Setting financial reminders

Setting financial reminders for bill payments and deadlines is crucial to avoid missing due dates and incurring late fees. Personal finance apps allow users to schedule reminders for upcoming payments, ensuring that they are aware of their financial commitments.

- Users can set reminders for recurring bills such as rent, utilities, and credit card payments to ensure timely payments.

- Financial reminders help users track their expenses and budget effectively, preventing overspending.

- By receiving notifications for upcoming payments, users can plan their finances accordingly and avoid any financial surprises.

Automation features for bill payments

Personal finance apps offer automation features that simplify bill payments and other financial tasks, making it easier for users to manage their finances efficiently.

- Users can set up automatic payments for recurring bills, eliminating the need to manually process payments each month.

- Automation features help users save time and reduce the risk of missing payments, ensuring that bills are paid on time.

- By automating bill payments, users can streamline their financial management process and focus on other important aspects of their lives.

User interface and ease of navigation

When it comes to personal finance apps, the user interface and ease of navigation play a crucial role in determining the overall user experience. A well-designed interface can make it easier for users to track their finances, set budgets, and manage investments effectively.

Intuitive navigation, on the other hand, ensures that users can easily find the features they need without getting lost in a sea of complicated menus and options.

Importance of intuitive navigation

- Intuitive navigation allows users to quickly access key features such as budgeting tools, expense tracking, and investment insights.

- Easy-to-use interfaces reduce the learning curve for new users, making it more likely that they will stick with the app long-term.

- Clear navigation menus and buttons help users stay organized and focused on their financial goals.

Tips for choosing an app with a user-friendly interface

- Look for apps with clean, uncluttered layouts that prioritize essential features.

- Read user reviews to see if others have had positive experiences with the app's interface and navigation.

- Test out a few different apps to see which one feels the most intuitive and easy to use for your specific needs.

Enhancing user experience with a well-designed interface

- A visually appealing interface can make managing finances feel less like a chore and more like a seamless part of daily life.

- Intuitive navigation tools can help users stay on top of their financial health by providing quick access to important information.

- Customizable dashboards and reports can give users a clear overview of their financial situation at a glance.

Ultimate Conclusion

In conclusion, the realm of personal finance apps for the digital lifestyle offers a wealth of opportunities for users to take control of their financial health. From budgeting and expense tracking to investment and savings features, these apps pave the way for a secure and prosperous financial future.

FAQ Overview

How are personal finance apps beneficial for managing finances?

Personal finance apps offer convenience, real-time tracking, and tools for budgeting and investment, making financial management more efficient and accessible.

Are personal finance apps safe to use for managing sensitive financial data?

Most personal finance apps implement robust security measures like encryption and two-factor authentication to safeguard users' financial information.

Can personal finance apps help in setting and achieving savings goals?

Yes, many personal finance apps provide features to set savings goals, track progress, and offer insights on saving money effectively.

Do personal finance apps offer bill payment reminders?

Personal finance apps often include bill payment functionalities and reminders to help users stay on top of their financial obligations.

How important is the user interface of personal finance apps?

A user-friendly interface is crucial for seamless navigation and better user experience, ensuring users can manage their finances effectively.